Net Income Calculator

Net income is a fundamental concept in finance and accounting that represents the amount of money a business or individual earns after deducting all expenses, taxes, and other costs. Whether you are managing personal finances or running a business, understanding how to calculate net income is crucial for assessing financial health. This blog post will guide you through the steps of calculating net income, explain its importance, and answer frequently asked questions.

What is Net Income?

Net income is the profit left over after subtracting all expenses from total revenue. It is often referred to as the “bottom line” and is a key indicator of profitability. Net income can be calculated for individuals to understand their earnings after taxes and deductions, or for businesses to determine the profit after all costs have been accounted for.

The formula for net income is:

Where:

Total Revenue includes all income from sales, services, and other sources.

Total Expenses include operating expenses, taxes, interest, depreciation, and any other costs.

Step-by-Step Guide to Calculate Net Income

Calculating net income involves several steps, whether for personal finances or a business. Here’s a detailed guide:

Step 1: Calculate Total Revenue

The first step in calculating net income is to determine the total revenue. For businesses, this includes income from product sales, services, interest, or any other sources.

Example:

Revenue from product sales: $50,000

Revenue from services: $10,000

Total Revenue = $50,000 + $10,000 = $60,000

Step 2: Determine Total Expenses

Next, calculate total expenses. This includes operating expenses, salaries, rent, utilities, interest on loans, taxes, and any other costs incurred.

Example:

Operating expenses: $20,000

Salaries: $15,000

Rent: $5,000

Taxes: $3,000

Other expenses: $2,000

Total Expenses = $20,000 + $15,000 + $5,000 + $3,000 + $2,000 = $45,000

Step 3: Subtract Total Expenses from Total Revenue

Finally, subtract the total expenses from total revenue to find the net income.

Example:

Total Revenue = $60,000

Total Expenses = $45,000

Net Income = $60,000 – $45,000 = $15,000

Final Answer: The net income is $15,000.

Why is Net Income Important?

Measure of Profitability: Net income is a primary indicator of a business’s profitability. A positive net income means the business is profitable, while a negative net income indicates a loss.

Financial Decision-Making: Net income helps individuals and businesses make informed decisions about spending, investments, and cost management.

Tax Calculations: Net income is used to calculate income taxes for both individuals and businesses.

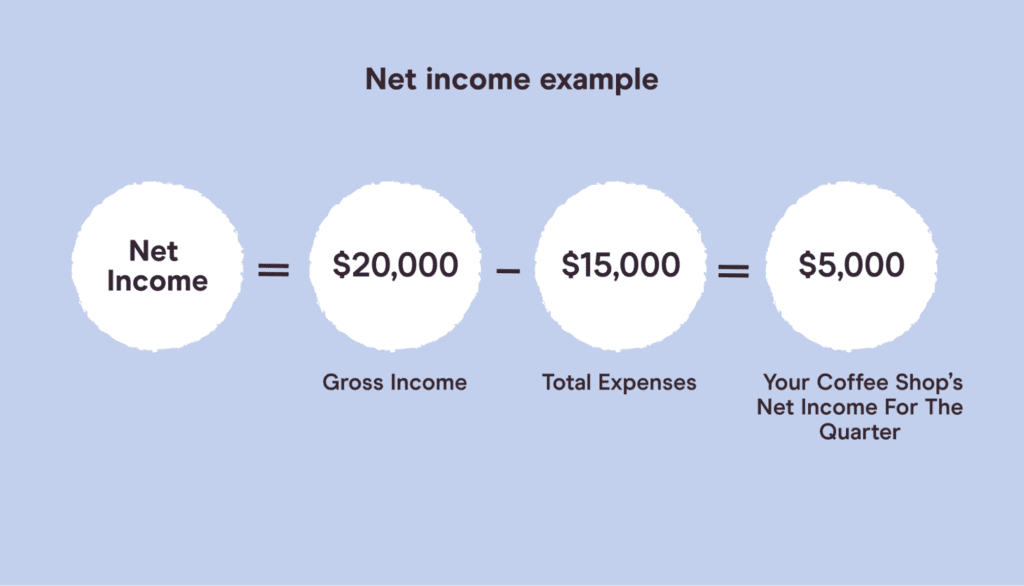

Net Income vs. Gross Income

It is important to differentiate between net income and gross income:

Gross Income: The total income earned before any expenses or deductions.

Net Income: The income left after all expenses, deductions, and taxes are subtracted from the gross income.

For individuals, gross income includes wages or salary before taxes, while net income is what they take home after deductions. For businesses, gross income is total revenue minus the cost of goods sold (COGS), whereas net income is what remains after all other operating expenses, interest, and taxes are deducted.

Example Calculation for Individuals

If you want to calculate your personal net income, follow these steps:

Determine Gross Income: Add all sources of income, such as salary, bonuses, and freelance work.

Salary: $4,000/month

Freelance work: $500/month

Gross Income = $4,000 + $500 = $4,500

Subtract Deductions and Expenses: Deduct taxes, insurance, retirement contributions, and other expenses.

Taxes: $800

Health insurance: $200

Retirement contributions: $300

Total Deductions = $800 + $200 + $300 = $1,300

Calculate Net Income: Subtract total deductions from gross income.

Net Income = $4,500 – $1,300 = $3,200

Final Answer: The net income is $3,200 per month.

Frequently Asked Questions about Net Income

Q1: What is the formula for calculating net income?

The formula for net income is:

Q2: How is net income different from gross income?

Gross income is the total income earned before any expenses or deductions, while net income is what remains after all expenses, deductions, and taxes are subtracted from gross income.

Q3: Why is net income important for businesses?

Net income is important because it indicates the profitability of a business. It helps stakeholders assess financial performance and make informed decisions about investments and cost management.

Q4: Can net income be negative?

Yes, net income can be negative. When total expenses exceed total revenue, the business or individual experiences a net loss.

Q5: What are some common expenses that affect net income?

Common expenses include operating costs, salaries, rent, utilities, taxes, interest on loans, and depreciation.

Q6: How is net income used in personal finance?

In personal finance, net income is the amount of money you take home after deductions such as taxes, insurance, and retirement contributions. It helps you determine your budget and spending capacity.

Q7: How can I increase my net income?

To increase net income, you can either increase your revenue (e.g., by selling more products or services) or reduce expenses (e.g., by cutting unnecessary costs or finding more efficient processes).

Q8: Is net income the same as profit?

Yes, net income is often referred to as profit, especially in the context of businesses. It represents the amount left after all costs have been deducted from revenue.

Q9: How does depreciation affect net income?

Depreciation is an expense that reduces the value of assets over time. It is subtracted from revenue, which reduces the net income, even though it is a non-cash expense.

Q10: What role does net income play in tax calculations?

Net income is used to determine taxable income for both individuals and businesses. It forms the basis for calculating how much tax is owed to the government.

Conclusion

Calculating net income is an essential skill for both individuals and businesses to understand financial health. By subtracting all expenses from total revenue, you can determine how profitable you are or how well your business is performing. Whether you’re preparing financial statements for your business or managing your personal budget, understanding net income will help you make more informed financial decisions.