Profit Margin Calculator

How to Calculate Profit Margin

Profit margin is a financial metric used to assess a company's profitability by measuring how much profit is made relative to its revenue. It's expressed as a percentage and represents how much of every dollar of revenue a business retains as profit after covering its costs.

Formula for Profit Margin:

Profit Margin = (Net Income / Total Revenue) × 100

Where: Net Income = Total Revenue - Total Cost

Step-by-Step Guide to Calculate Profit Margin

Calculate Total Revenue

The first step is to determine total revenue. For businesses, this includes income from product sales, services, and any other sources.

Calculate Total Cost

Next, calculate total costs, which include all expenses such as operating costs, salaries, rent, and taxes.

Subtract Total Costs from Total Revenue

Once you know the total revenue and total costs, subtract the total costs from the total revenue to get net income.

Divide Net Income by Total Revenue

To calculate profit margin, divide the net income by the total revenue.

Multiply by 100 to Get the Percentage

Finally, multiply the result by 100 to express the profit margin as a percentage.

Why is Profit Margin Important?

Profit margin is crucial for evaluating the financial health and profitability of a business. It helps determine how well a company manages its expenses relative to its revenue.

- Performance Indicator: A higher profit margin indicates that a company is making more money for every dollar of sales.

- Competitive Analysis: Compare your profit margins with industry standards to see how your business stacks up against competitors.

- Financial Planning: Use profit margin to set pricing strategies and identify areas to cut costs.

- Investor Interest: Attractive profit margins can make your business more appealing to potential investors.

Profit margin is an essential financial metric that helps businesses determine how much profit they make relative to their sales. Calculating profit margin is crucial for assessing the financial health and profitability of a business. In this blog post, we will explain how to calculate profit margin, why it is important, and provide answers to frequently asked questions to help you understand this critical concept.

What is Profit Margin?

Profit margin is the percentage of revenue that a company keeps as profit after accounting for all its expenses. It is a key indicator of a company’s efficiency in managing its costs and generating profit from sales. A higher profit margin means that a company is more efficient at converting sales into actual profit.

There are different types of profit margins, including gross profit margin, operating profit margin, and net profit margin:

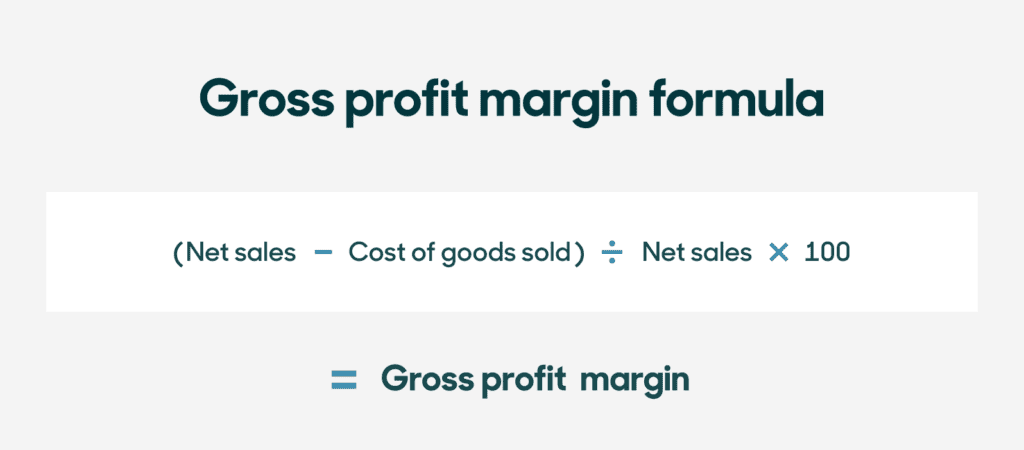

Gross Profit Margin: Measures profit after accounting for the cost of goods sold (COGS).

Operating Profit Margin: Measures profit after accounting for operating expenses.

Net Profit Margin: Measures profit after all expenses, including taxes and interest.

The formula for calculating profit margin is:

Step-by-Step Guide to Calculate Profit Margin

Step 1: Calculate Total Revenue

The first step is to determine your total revenue, which is the total income generated from sales of goods or services.

Example:

Total Revenue = $100,000

Step 2: Calculate Net Profit

Next, calculate the net profit by subtracting all expenses from the total revenue. This includes operating costs, salaries, rent, utilities, taxes, and interest.

Example:

Total Expenses = $75,000

Net Profit = Total Revenue – Total Expenses = $100,000 – $75,000 = $25,000

Step 3: Calculate Profit Margin

To calculate the profit margin, divide the net profit by the total revenue and multiply by 100 to get the percentage.

Example:

Profit Margin =

Final Answer: The profit margin is 25%.

Types of Profit Margins

Gross Profit Margin: This measures the percentage of revenue that exceeds the cost of goods sold (COGS). It is calculated as:

ight) imes 100 ]

Operating Profit Margin: This measures how much profit a company makes after paying for variable costs of production, such as wages and raw materials, but before paying interest or taxes.

ight) imes 100 ]

Net Profit Margin: This measures the percentage of revenue that remains as profit after all expenses, including operating expenses, interest, and taxes, have been deducted.

ight) imes 100 ]

Why is Profit Margin Important?

Measure of Profitability: Profit margin is a key indicator of how efficiently a business is generating profit relative to its revenue.

Financial Health: A higher profit margin means that a company is better at converting sales into actual profit, which is crucial for sustainability.

Benchmarking: Profit margins allow companies to compare their performance with competitors and industry standards.

Frequently Asked Questions about Profit Margin

Q1: What is the formula for calculating profit margin?

The formula for profit margin is:

Q2: What is a good profit margin?

A “good” profit margin varies by industry. Generally, a higher profit margin indicates better financial health. For example, profit margins above 20% are considered good in most industries, but it depends on the specific business and market conditions.

Q3: How do gross profit margin and net profit margin differ?

Gross profit margin measures the percentage of revenue that exceeds the cost of goods sold, while net profit margin measures the percentage of revenue that remains after all expenses, including taxes and interest, have been deducted.

Q4: Why is profit margin important for businesses?

Profit margin is important because it helps assess a business’s efficiency in managing costs and generating profits. It also allows stakeholders to evaluate the company’s financial health and make informed decisions.

Q5: Can profit margin be negative?

Yes, profit margin can be negative if a company’s expenses exceed its total revenue, resulting in a net loss.

Q6: How do you calculate gross profit margin?

To calculate gross profit margin, subtract the cost of goods sold (COGS) from total revenue, then divide by total revenue and multiply by 100.

Q7: How can I improve my profit margin?

To improve profit margin, you can increase revenue (e.g., by raising prices or selling more) or reduce expenses (e.g., by cutting costs or improving operational efficiency).

Q8: What is the difference between markup and profit margin?

Markup is the amount added to the cost of a product to determine its selling price, while profit margin is the percentage of the selling price that is profit. Markup focuses on the cost, whereas profit margin focuses on revenue.

Q9: How is profit margin used in financial analysis?

Profit margin is used in financial analysis to evaluate a company’s ability to generate profit relative to sales. It helps analysts compare profitability across companies and industries.

Q10: Is operating profit margin the same as EBITDA margin?

No, operating profit margin includes depreciation and amortization, while EBITDA margin (Earnings Before Interest, Taxes, Depreciation, and Amortization) excludes them, giving a different perspective on profitability.

Conclusion

Calculating profit margin is essential for understanding the profitability of a business. It helps assess how well a company is converting revenue into profit and provides insights into financial efficiency. Whether you’re running a small business or managing a large corporation, understanding profit margins will help you make informed decisions about pricing, cost control, and overall financial strategy.

Now that you know how to calculate profit margin, try applying these steps to your business to get a clear picture of your financial health and profitability.