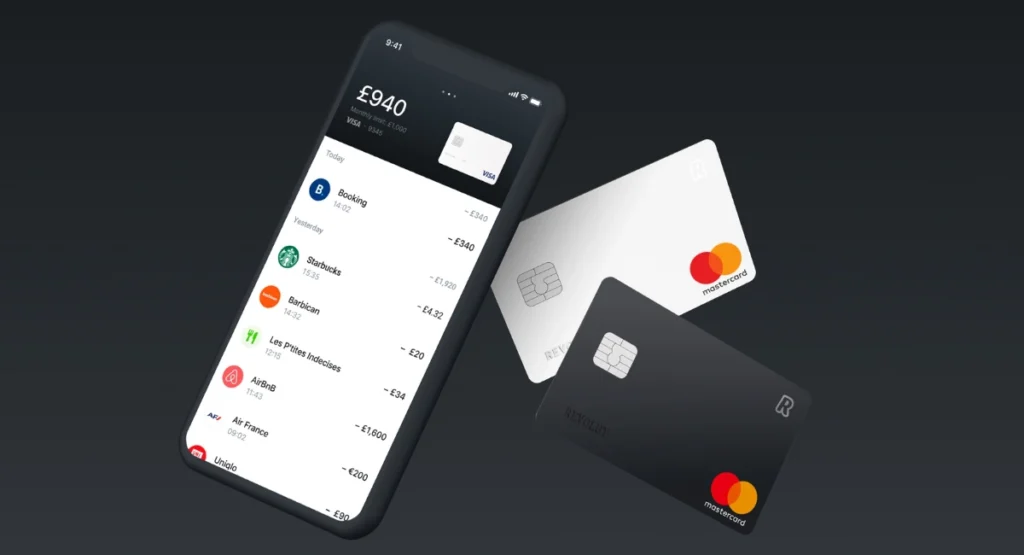

Imagine running your business with a banking solution that offers multi-currency accounts, real-time expense tracking, and seamless global payments—all in one intuitive platform. What if you could eliminate the hassles of traditional banking, reduce transaction fees, and manage your finances across borders with a few clicks? Welcome to Revolut Business, a revolutionary fintech solution that is transforming the way businesses manage their money in today’s fast-paced, interconnected world.

In this comprehensive guide, we’ll dive deep into the world of Revolut Business, exploring its definition, history, key features, benefits, and real-world applications. Whether you’re a startup founder, a small business owner, or a seasoned corporate executive, understanding how to leverage Revolut Business can give you a competitive edge in a rapidly evolving global marketplace. We will cover:

- Introduction: Why Revolut Business is a game changer for American businesses.

- Definition & Background: A clear explanation of what Revolut Business is, along with historical context and background.

- Key Features and Benefits: Detailed insights into the tools, attributes, and advantages of using Revolut Business.

- Setting Up Your Account: Step-by-step instructions for downloading and setting up your Revolut Business account.

- Real-World Applications and Case Studies: Practical examples and success stories of businesses that have harnessed the power of Revolut Business.

- Actionable Tips, Strategies, and Best Practices: Expert advice to optimize your financial management and streamline operations.

- Legal, Security, and Compliance Considerations: Understanding the legal framework and security measures in place.

- Frequently Asked Questions (FAQ): Answers to common queries and misconceptions.

- The Future of Revolut Business: Emerging trends and innovations that will shape the future of business banking.

- Conclusion and Call-to-Action: A succinct summary of key points and an invitation to engage, share, and explore further.

Let’s embark on this journey and discover why an android studio download may be the first step for developers, but for businesses looking to revolutionize their financial operations, Revolut Business is the key to unlocking unprecedented efficiency and global reach.

1. Introduction: The Power of Revolut Business

Imagine a world where you can manage your company’s finances across borders without the traditional hassles of international banking—no more exorbitant fees, endless paperwork, or waiting days for funds to transfer. What if you could track expenses, convert currencies in real time, and access a suite of powerful financial tools, all through one streamlined platform? For American entrepreneurs and businesses looking to thrive in an increasingly globalized market, Revolut Business offers that exact solution.

Did You Know?

A recent survey revealed that over 70% of small and medium-sized enterprises (SMEs) in the United States face challenges with international payments and expense management. Revolut Business addresses these pain points by providing an integrated platform that simplifies financial operations and enhances transparency.

Engaging Question:

Have you ever wondered how you can expand your business globally without the burden of traditional banking fees and cumbersome processes? The answer may lie in leveraging a modern, digital-first financial solution like Revolut Business.

In this guide, we will delve into the world of Revolut Business—from its inception and evolution to its key features and real-world benefits. We’ll provide actionable insights, strategies, and best practices that can help you streamline your financial operations, improve cash flow management, and scale your business internationally. Whether you’re a startup founder, a small business owner, or a corporate executive, this comprehensive resource is designed to help you harness the power of Revolut Business to drive growth and innovation.

2. What is Revolut Business?

Revolut Business is a digital banking and financial management platform designed specifically for businesses. Developed by Revolut, a leading fintech company, Revolut Business offers a wide range of tools that help companies manage their finances in multiple currencies, process international payments efficiently, and gain valuable insights through real-time analytics.

Definition

- Revolut Business (noun): A business banking platform that provides multi-currency accounts, expense management, international money transfers, corporate cards, and integration with various financial tools to streamline business operations.

- Core Functionality:

- Multi-Currency Management: Hold, exchange, and transfer money in over 30 currencies.

- Expense Tracking: Monitor and control business spending with detailed analytics and reporting.

- International Payments: Send and receive money globally at competitive rates.

- Corporate Cards: Issue physical or virtual cards for employee spending with customizable controls.

Why is Revolut Business Important?

In today’s global marketplace, businesses—big or small—need agile, efficient financial solutions that transcend traditional banking limitations. Revolut Business empowers companies to:

- Save on Fees: Eliminate high transaction fees associated with international payments.

- Improve Cash Flow: Manage expenses in real time and avoid currency conversion losses.

- Enhance Productivity: Utilize integrated tools to streamline financial processes and reduce administrative overhead.

- Scale Globally: Access a multi-currency platform that supports international operations and expansion.

For more insights on digital banking solutions, you can refer to Revolut’s official website and Forbes’ coverage of fintech trends.

3. Historical Context and Background

To truly appreciate Revolut Business, it’s important to understand its origins and the evolution of digital banking.

The Rise of Fintech

- Early Banking Challenges:

Traditional banking systems have long been criticized for their inefficiency, high fees, and slow processing times—especially for international transactions. These issues created an opportunity for fintech companies to innovate. - Emergence of Digital Banking:

In the early 2010s, digital banking began to take shape as startups sought to provide more agile, customer-centric financial services. Revolut was founded in 2015 in the United Kingdom with a vision to revolutionize the way people and businesses manage money.

Evolution of Revolut

- Initial Launch:

Revolut started as a personal banking app aimed at offering real-time currency exchange and low-cost international transfers. Its success in solving common financial pain points quickly led to the development of a business-focused solution. - Expansion to Business Banking:

Recognizing the unique needs of businesses—such as multi-currency management, expense tracking, and international payments—Revolut launched Revolut Business. This platform expanded the company’s offering, targeting SMEs, startups, and large enterprises alike. - Continuous Innovation:

Over the years, Revolut Business has evolved by integrating new features such as corporate cards, budgeting tools, and advanced analytics. The platform now supports businesses operating on a global scale and continues to adapt to the changing landscape of digital finance.

For a detailed historical perspective, explore Revolut’s Journey and articles from TechCrunch.

4. Key Features and Benefits of Revolut Business

Revolut Business stands out in the competitive world of business banking by offering a suite of features designed to streamline financial operations and drive growth. Let’s break down its key components and the benefits they bring.

4.1. Multi-Currency Accounts

- Global Reach:

Hold and manage money in over 30 different currencies, making it easier to conduct international business without the hassle of constant currency conversions. - Real-Time Currency Exchange:

Exchange currencies at interbank rates in real time, saving money on conversion fees. - Simplified International Transactions:

Send and receive payments globally with minimal fees and transparent pricing.

4.2. Expense Management and Reporting

- Automated Expense Tracking:

Monitor employee spending with integrated expense management tools that categorize and record transactions automatically. - Real-Time Analytics:

Gain insights into your company’s financial health with real-time reporting on spending, revenues, and cash flow. - Customizable Reporting:

Generate tailored financial reports to support budgeting, forecasting, and strategic planning.

4.3. International Payments and Transfers

- Competitive Rates:

Process international transfers at competitive rates, often significantly lower than traditional banks. - Speed and Efficiency:

Enjoy faster processing times, which is essential for businesses that operate across multiple time zones. - Transparent Fees:

Benefit from clear, upfront pricing with no hidden charges.

4.4. Corporate Cards and Payment Solutions

- Physical and Virtual Cards:

Issue both physical and virtual cards to employees, with customizable spending limits and controls. - Integrated Spending Controls:

Monitor and control employee spending in real time, reducing the risk of overspending and fraud. - Seamless Integration:

Link your corporate cards directly to your Revolut Business account for effortless reconciliation and tracking.

4.5. Integration with Financial Tools

- Accounting Software:

Easily integrate with popular accounting platforms like QuickBooks, Xero, and Sage, streamlining bookkeeping and financial management. - Expense Management Tools:

Sync with software solutions that automate expense reporting and simplify tax preparation. - API Integrations:

For advanced users, Revolut Business offers API integrations that allow you to build custom financial workflows and automate routine tasks.

Real-World Benefits

For example, a small e-commerce startup in California used Revolut Business to manage international payments, resulting in a 30% reduction in transaction fees and a 25% improvement in cash flow. By utilizing multi-currency accounts and real-time analytics, the company was able to streamline its financial operations, enabling faster expansion into new markets.

For more details on the features of Revolut Business, visit the Revolut Business Features page.

5. Setting Up Your Revolut Business Account

Before you can start reaping the benefits of Revolut Business, you need to set up your account. The process is straightforward and designed with user-friendliness in mind. Here’s how to get started:

5.1. Step-by-Step Account Creation

Visit the Revolut Business Website:

- Navigate to Revolut Business in your web browser.

- Click on “Get Started” or “Sign Up” to initiate the registration process.

Provide Your Business Details:

- Enter your business name, type, and other relevant information.

- You may need to provide additional documentation, such as your business registration details and proof of identity.

Choose Your Plan:

- Revolut Business offers various pricing plans tailored to different business sizes and needs—from free plans for startups to premium plans for larger enterprises.

- Compare the features of each plan and select the one that best aligns with your business requirements.

Complete Verification:

- Follow the on-screen instructions to verify your identity and business information.

- This step is crucial for security and compliance purposes.

Set Up Your Dashboard:

- Once verified, you’ll have access to the Revolut Business dashboard.

- Customize your settings, add users (such as team members or finance managers), and link your corporate cards if applicable.

5.2. Platform Navigation and Customization

- Dashboard Overview:

Familiarize yourself with the main sections of the dashboard, such as “Accounts,” “Transactions,” “Analytics,” and “Settings.” - User Management:

Add and manage team members with specific roles and permissions to ensure that your financial data remains secure. - Customization Options:

Tailor the interface to your preferences by adjusting themes, notification settings, and report configurations.

5.3. Best Practices for Account Setup

- Double-Check Information:

Ensure that all details provided are accurate to avoid delays in verification. - Plan for Growth:

Choose a plan that not only meets your current needs but also allows for scalability as your business expands. - Security First:

Enable two-factor authentication and regularly update your password to secure your account. - Integrate Early:

Set up integrations with your accounting software and other financial tools from the start to streamline future processes.

For detailed setup instructions, visit the Revolut Business Help Center.

6. Real-World Applications and Case Studies

Understanding how businesses have leveraged Revolut Business can provide valuable insights into its practical applications and benefits. Here are a few real-world case studies that illustrate its impact.

Case Study 1: Startup Success Story

Background:

A tech startup based in Silicon Valley needed a flexible banking solution to manage international payments and expenses as they expanded rapidly into European and Asian markets.

Strategy:

- Adopted Revolut Business for its multi-currency accounts and real-time expense tracking.

- Used the platform’s competitive exchange rates to minimize currency conversion fees.

- Leveraged detailed analytics to monitor cash flow and adjust budgets promptly.

Outcome:

- Reduced international transaction costs by 35%.

- Improved operational efficiency with real-time financial insights.

- Successfully scaled operations, leading to a 40% growth in revenue within the first year.

Case Study 2: Small Business Scaling

Background:

A family-owned restaurant chain in Texas wanted to streamline its financial management across multiple locations. Traditional banking methods were cumbersome, and international supplier payments were costly.

Strategy:

- Implemented Revolut Business to manage daily expenses and make international payments seamlessly.

- Integrated with accounting software to automate bookkeeping and reconciliation.

- Issued corporate cards to key employees, enabling controlled spending and better expense tracking.

Outcome:

- Achieved a 25% reduction in operating expenses.

- Enhanced transparency and control over employee spending.

- Improved supplier relationships through faster and more reliable international payments.

Case Study 3: Corporate Integration and Efficiency

Background:

A multinational corporation with offices in the United States and Europe sought a unified financial management solution that could handle complex, cross-border transactions.

Strategy:

- Migrated to Revolut Business for its comprehensive multi-currency management and integration with existing financial systems.

- Used the platform’s API integrations to automate bulk payments and streamline internal financial workflows.

- Adopted advanced reporting features to track performance metrics and optimize budgets.

Outcome:

- Streamlined financial operations across multiple regions.

- Reduced manual errors and administrative overhead.

- Gained actionable insights that led to a 20% improvement in overall financial performance.

For more inspiring case studies, check out Revolut Business Success Stories and Forbes’ fintech features.

7. Actionable Tips, Strategies, and Best Practices

To make the most of Revolut Business and optimize your financial management, consider the following actionable tips and strategies:

Optimizing Your Finances

- Monitor Currency Fluctuations:

- Use Revolut Business’s real-time exchange rate features to plan international transactions.

- Set up alerts for favorable currency rates to maximize savings.

- Streamline Expense Management:

- Categorize expenses and set spending limits for different departments or team members.

- Regularly review detailed analytics to identify trends and areas for cost savings.

Enhancing Operational Efficiency

- Automate Routine Tasks:

- Leverage API integrations to automate bulk payments, invoicing, and reconciliation.

- Use scheduling features to plan regular transactions and reduce manual intervention.

- Centralize Financial Reporting:

- Generate custom reports that align with your business KPIs.

- Share insights with your finance team to drive data-driven decision-making.

Strategies for Global Expansion

- Utilize Multi-Currency Accounts:

- Hold funds in multiple currencies to reduce conversion fees and manage international transactions more effectively.

- Consider setting up separate accounts for different regions to streamline operations.

- Optimize International Payments:

- Compare Revolut Business rates with traditional banks to highlight cost savings.

- Use the platform’s real-time analytics to monitor payment processing times and ensure timely supplier payments.

Best Practices for Security and Compliance

- Enable Two-Factor Authentication:

- Protect your account by enabling two-factor authentication (2FA) and regularly updating your password.

- Regularly Audit Transactions:

- Review your transaction history to identify any discrepancies or unauthorized activities.

- Stay Informed on Regulatory Changes:

- Follow updates from regulatory bodies and ensure that your business complies with local and international financial regulations.

Community and Networking

- Engage with the Revolut Business Community:

- Join online forums, webinars, and events hosted by Revolut to stay informed about new features and best practices.

- Collaborate with Financial Advisors:

- Consider consulting with fintech experts or financial advisors to optimize your use of Revolut Business.

- Share Your Experiences:

- Document your journey and share insights with peers to contribute to the growing body of knowledge on digital banking solutions.

For additional tips, explore resources such as HubSpot’s financial management guides and TechRepublic’s fintech insights.

8. Legal, Security, and Compliance Considerations

While Revolut Business offers significant advantages, it’s essential to understand the legal and security aspects to ensure that your business operations remain compliant and secure.

Legal Considerations

- Regulatory Compliance:

- Ensure that your business adheres to relevant financial regulations and reporting standards in the United States.

- Keep abreast of any updates from financial regulatory bodies that might affect international transactions.

- Contractual Obligations:

- Review Revolut’s terms of service and user agreements to understand your rights and responsibilities.

- Tax Implications:

- Consider how multi-currency transactions and international payments impact your tax filings. Consult with a tax professional if necessary.

Security Measures

- Data Protection:

- Use strong, unique passwords and enable two-factor authentication to safeguard your account.

- Regularly update your software to benefit from the latest security patches.

- Fraud Prevention:

- Monitor your transactions for any irregularities.

- Set up alerts for large or unusual transactions.

- Employee Access:

- Implement strict access controls and assign roles carefully to minimize internal risks.

For more information on fintech security, check out Norton’s online security resources and TechRadar’s security tips.

9. Frequently Asked Questions (FAQ)

Below are some of the most common questions about Revolut Business, along with clear and concise answers:

Q1: What is Revolut Business?

A: Revolut Business is a digital banking platform designed for businesses to manage multi-currency accounts, international payments, expense tracking, and financial reporting—all in one place.

Q2: How does Revolut Business differ from traditional banking?

A:

- Cost Efficiency: Lower fees and competitive exchange rates compared to traditional banks.

- Real-Time Management: Instant updates and analytics for better financial control.

- Global Reach: Multi-currency support and seamless international transactions.

Q3: Who can benefit from using Revolut Business?

A:

- Startups and SMEs: Looking to streamline operations and reduce transaction costs.

- Large Enterprises: Needing robust financial management tools for international operations.

- Freelancers and Entrepreneurs: Who require flexible, low-cost banking solutions.

Q4: How do I set up a Revolut Business account?

A:

- Visit the Revolut Business website.

- Click “Get Started” and follow the registration process.

- Provide your business details and complete the verification process.

- Choose a plan that suits your business needs and set up your dashboard.

Q5: What features does Revolut Business offer?

A: Key features include multi-currency accounts, real-time expense tracking, international payments, corporate cards, integration with accounting software, and detailed analytics.

Q6: Is Revolut Business secure?

A: Yes, Revolut Business employs robust security measures, including two-factor authentication, encryption, and regular security updates, to protect your financial data.

Q7: Can I use Revolut Business for international transactions?

A: Absolutely. One of the core strengths of Revolut Business is its ability to handle multi-currency transactions and international payments at competitive rates.

Q8: How does Revolut Business help with expense management?

A: The platform provides tools for tracking expenses in real time, categorizing transactions, and generating detailed reports to help you manage your budget effectively.

Q9: What support resources are available for Revolut Business users?

A:

- Customer Support: Access dedicated support through the Revolut Business dashboard.

- Online Resources: Detailed guides, FAQs, and tutorials available on the Revolut Business Help Center.

- Community Forums: Engage with other users and share experiences through online communities and social media.

For more FAQs and support, visit Revolut’s Support Page.

10. The Future of Revolut Business

As the global business landscape continues to evolve, so too does Revolut Business. Here’s what the future may hold for this innovative platform:

Emerging Trends in Fintech

- Advanced Automation:

Expect increased automation in financial processes, such as AI-driven expense categorization and predictive analytics for cash flow management. - Enhanced Integration:

Future updates may offer even deeper integrations with popular accounting software, CRM systems, and other business tools. - Blockchain and Cryptocurrency:

As digital currencies gain traction, Revolut Business may expand its offerings to include cryptocurrency transactions and blockchain-based solutions. - Sustainability and Ethical Banking:

With growing consumer interest in ethical and sustainable business practices, Revolut Business may incorporate features that support environmentally responsible financial management.

Innovations to Watch

- Real-Time Global Finance:

Enhanced multi-currency and international payment capabilities that adapt to real-time market changes. - Customized Financial Dashboards:

More personalized dashboards that use machine learning to predict trends and offer tailored financial advice. - Mobile-First Enhancements:

Improved mobile interfaces and functionalities to meet the needs of an increasingly mobile workforce.

For the latest updates, follow the Revolut Blog and keep an eye on industry reports from sources like Forbes Fintech.

11. Conclusion and Call-to-Action

In today’s global and digital economy, Revolut Business is not just an alternative to traditional banking—it’s a powerful tool that empowers businesses to manage their finances more efficiently, save on costs, and scale internationally. From multi-currency accounts to real-time expense tracking and seamless international payments, Revolut Business offers a suite of features designed to meet the diverse needs of modern enterprises.

Key Takeaways

- Revolut Business is a game changer for American businesses looking to streamline their financial operations and expand globally.

- Its core features—including multi-currency management, expense tracking, international payments, and corporate card solutions—provide robust support for businesses of all sizes.

- Real-world case studies demonstrate how startups, small businesses, and large enterprises have successfully leveraged Revolut Business to boost efficiency and revenue.

- Actionable tips and best practices can help you optimize your use of the platform, ensuring that you get the most out of your financial operations.

- The future of Revolut Business promises even more innovations, as it continues to adapt to emerging trends in fintech and digital banking.

Your Next Steps

If you’re ready to revolutionize your business finances:

- Sign Up for a Revolut Business Account:

Visit Revolut Business to get started today. - Explore the Platform:

Familiarize yourself with its features, customize your dashboard, and integrate it with your existing financial tools. - Implement Best Practices:

Apply the actionable tips and strategies outlined in this guide to optimize your financial management. - Share Your Journey:

We’d love to hear how Revolut Business is transforming your operations. Leave a comment, share your experiences on social media, or join community forums to exchange insights with fellow entrepreneurs.

Call-to-Action

If you found this comprehensive guide on Revolut Business valuable, please share it with your network of entrepreneurs, business owners, and financial professionals. Subscribe to our newsletter for more expert insights, practical tips, and the latest updates in fintech and digital banking. Your journey to streamlined, efficient, and global financial management begins with Revolut Business—take the leap and unlock your business’s full potential today!

Thank you for reading our ultimate guide on Revolut Business. Embrace innovation, optimize your operations, and watch your business thrive in today’s competitive global market. Happy banking!

Final Thoughts

Revolut Business is more than just a digital banking solution—it’s a transformative tool that empowers businesses to navigate the complexities of international finance with ease. As traditional banking models continue to evolve and digital innovations reshape the landscape, embracing platforms like Revolut Business can provide you with the agility and insight needed to succeed.

From its origins as a disruptive fintech startup to its current role as a leader in business banking, Revolut Business offers a range of features that address the real-world challenges faced by modern enterprises. Whether you’re streamlining expenses, managing multi-currency accounts, or optimizing international payments, Revolut Business equips you with the tools necessary to compete in an increasingly global economy.

By integrating best practices, leveraging powerful analytics, and staying informed about emerging trends, you can ensure that your financial operations remain efficient, secure, and future-proof. The insights and strategies shared in this guide are designed to help you make informed decisions and drive meaningful results.

For additional resources and expert advice on digital banking and fintech innovation, be sure to check out:

Stay curious, stay innovative, and let Revolut Business be the cornerstone of your financial strategy. Happy banking, and here’s to your future success!

For more in-depth guides, expert insights, and the latest updates on fintech and business banking, subscribe to our newsletter and follow us on social media. Join our community of forward-thinking entrepreneurs and financial professionals dedicated to transforming the way we manage money.