Understanding Reasonable Salary for Corporations

Determining a reasonable salary for your corporation is a pivotal aspect of effective tax strategy and compliance. Whether you're an owner-employee of an S-corporation or operating under a different business structure, understanding how to set a reasonable salary can optimize your tax benefits while ensuring adherence to IRS regulations.

Introduction

For business owners, especially those operating as S-corporations, balancing salary and distributions is essential to optimize tax liabilities. The IRS mandates that owner-employees receive a reasonable salary for the work they perform before taking distributions. This practice ensures proper payment of payroll taxes and prevents tax evasion through misclassification of income.

This guide delves into the concept of a reasonable salary, why it's important, how to determine it, and best practices to maintain compliance while maximizing your tax benefits.

What is a Reasonable Salary?

A reasonable salary refers to the compensation an owner-employee of a corporation receives for their services to the business. It should be comparable to what similar roles in the industry and geographic area would command. The salary must reflect the value of the work performed, considering factors like expertise, responsibilities, and time commitment.

For S-corporations, this concept is particularly significant as it differentiates between salary (subject to payroll taxes) and distributions (which are not), thereby impacting overall tax obligations.

Importance of Reasonable Salary

Setting a reasonable salary is crucial for several reasons:

- IRS Compliance: The IRS scrutinizes S-corporations to ensure owner-employees are not underpaying themselves to avoid payroll taxes. Non-compliance can result in audits, penalties, and additional taxes.

- Tax Optimization: Properly balancing salary and distributions can minimize overall tax liabilities. Salaries are subject to payroll taxes, while distributions are not, allowing for tax-efficient income management.

- Business Credibility: Maintaining a reasonable salary reflects the business's professionalism and financial health, which can be beneficial for securing loans and attracting investors.

- Employee Benefits: A reasonable salary ensures that employee benefits tied to income, such as retirement contributions and insurance, are appropriately calculated and funded.

How to Determine a Reasonable Salary

Determining a reasonable salary involves evaluating several key aspects of your role and the business's operations. Here’s a step-by-step approach:

- Assess Your Role and Responsibilities: Clearly define the duties you perform within the corporation. Consider the complexity, scope, and level of responsibility involved.

- Research Industry Standards: Utilize salary surveys, industry reports, and compensation data to understand what similar roles command in your industry and geographic area.

- Evaluate Your Experience and Qualifications: Factor in your education, experience, and any specialized skills that add value to your role.

- Consider the Business's Financial Health: Analyze the corporation’s profitability, revenue, and financial stability to determine what the business can reasonably afford to pay.

- Review Comparable Salaries: Compare your potential salary with that of employees in similar positions within similar businesses.

- Consult with a Tax Professional: Engage a tax advisor or accountant to review your salary determination process and ensure compliance with IRS guidelines.

Factors to Consider When Setting a Reasonable Salary

Several factors influence what constitutes a reasonable salary. Understanding these can help you make informed decisions:

- Duties and Responsibilities: The complexity and scope of your role impact the appropriate salary level.

- Experience and Education: Higher qualifications and extensive experience typically warrant higher compensation.

- Industry Standards: Compensation norms vary across industries, influencing what is considered reasonable.

- Geographic Location: Salaries differ based on the cost of living and economic conditions in different regions.

- Time Devoted to the Business: Full-time involvement may justify a higher salary compared to part-time engagement.

- Business Profitability: The financial health of the business determines what it can afford to pay.

- Comparable Positions: Salaries of similar roles in other businesses provide a benchmark for setting your own compensation.

Methods to Calculate a Reasonable Salary

1. Salary Surveys and Industry Reports

Utilize salary surveys and industry compensation reports to gather data on typical salaries for roles similar to yours. Websites like Glassdoor, Payscale, and the Bureau of Labor Statistics offer valuable insights.

A software developer in San Francisco might earn an average salary of $120,000 $ annually based on industry reports, whereas the same role in a smaller city might command $90,000.

2. Cost of Living Adjustments

Adjust your salary based on the cost of living in your geographic location. Areas with higher living costs generally support higher salaries.

If you move from a city with a cost of living index of 100 to one with an index of 150, you might adjust your salary upward by 50% to maintain the same standard of living.

3. Comparable Business Analysis

Analyze salaries paid by similar businesses within your industry and region. This comparative approach ensures your salary aligns with market expectations.

If competitor businesses of similar size and scope pay their CEO $150,000 annually, setting your salary in a similar range would be considered reasonable.

4. Financial Capacity of the Business

Assess your business’s profitability and cash flow to determine what it can afford to pay without jeopardizing operations.

A business generating $500,000 in revenue with $300,000 in expenses might reasonably pay its owner a salary of $100,000, ensuring sufficient funds remain for growth and unexpected costs.

5. Time and Effort Analysis

Evaluate the amount of time and effort you invest in the business. Greater involvement typically justifies higher compensation.

An owner working 60 hours a week versus one working 20 hours a week should reflect this difference in their respective salaries.

Tools and Resources for Determining a Reasonable Salary

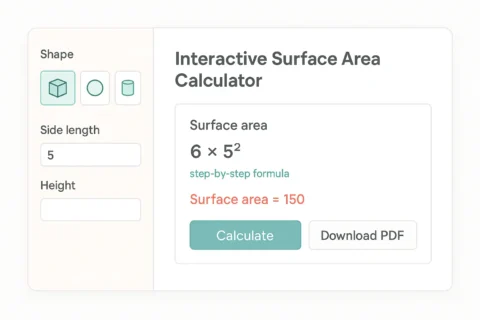

1. Online Salary Calculators

Online salary calculators can provide quick estimates based on industry, location, and role. Websites like Glassdoor, Payscale, and Salary.com offer such tools.

Using Glassdoor's salary calculator, you can input your role and location to receive an estimated salary range for a reasonable compensation package.

2. Accounting Software

Accounting software like QuickBooks or Xero can help track your business’s financial performance, aiding in determining what the business can afford to pay as salary.

QuickBooks can generate financial reports that highlight revenue, expenses, and profitability, providing a clear picture of the business’s capacity to support a specific salary level.

3. Industry Reports and Surveys

Access detailed industry reports and surveys that provide comprehensive salary data for various roles within your sector.

Consult the Bureau of Labor Statistics or industry-specific publications to find up-to-date salary information relevant to your business.

4. Professional Consultation

Engage with a tax professional or accountant who can offer personalized advice and ensure your salary determination aligns with IRS guidelines.

A tax advisor can analyze your business’s financials and role responsibilities to recommend a reasonable salary that optimizes tax benefits and ensures compliance.

Common Mistakes to Avoid When Setting a Reasonable Salary

- Underpaying to Avoid Payroll Taxes: Paying an unreasonably low salary to minimize payroll taxes can attract IRS audits and penalties.

- Overpaying Beyond Industry Standards: Overcompensating can strain your business’s finances and reduce available funds for growth and operations.

- Neglecting Regular Reviews: Failing to periodically assess and adjust your salary can lead to discrepancies and compliance issues.

- Ignoring Documentation: Not maintaining adequate records to support your salary decisions can result in challenges during IRS audits.

- Relying Solely on Personal Preferences: Base your salary decisions on objective data and industry standards rather than personal financial needs.

- Inconsistent Compensation: Varying your salary significantly without clear justification can raise red flags with tax authorities.

- Failing to Consider All Factors: Overlooking key elements like business profitability, role responsibilities, and market rates can lead to inaccurate salary determinations.

- Using Inaccurate Data: Relying on outdated or irrelevant salary information can skew your compensation decisions.

- Not Consulting Professionals: Attempting to set a reasonable salary without expert advice can increase the risk of errors and non-compliance.

- Mixing Personal and Business Finances: Blurring the lines between personal and business finances can complicate salary determination and tax reporting.

Examples of Reasonable Salaries

Example 1: S-Corporation Owner-Employee

Sarah owns an S-corporation that provides graphic design services. Here's how she determines her reasonable salary:

- Assess Role and Responsibilities: Sarah handles client communications, project management, and design work.

- Research Industry Standards: Based on industry reports, a graphic design manager in her region earns between $60,000 and $80,000 annually.

- Evaluate Experience: With 10 years of experience, Sarah falls towards the higher end of the salary range.

- Consider Business Financials: Her business generates $500,000 in revenue with $300,000 in expenses.

- Determine Salary: Sarah sets her salary at $75,000, aligning with industry standards and her role’s demands.

- Document Decision: She maintains salary surveys and her job description to support her compensation choice.

Sarah’s reasonable salary of $75,000 ensures compliance with IRS guidelines while allowing her business to maintain healthy profits and reinvest in growth.

Example 2: Sole Proprietorship Transitioning to S-Corporation

John runs a successful consulting firm and decides to incorporate as an S-corporation. Here’s how he sets a reasonable salary:

- Determine Role: John is the primary consultant, managing client projects and business operations.

- Research Comparable Salaries: Consulting firm principals in his area earn between $100,000 and $150,000.

- Assess Experience and Qualifications: With 15 years in consulting, John justifies a higher salary.

- Analyze Business Profits: The business earns $400,000 annually with $250,000 in expenses.

- Set Salary: John chooses a reasonable salary of $120,000, balancing market standards and business profitability.

- Implement Tax Strategy: By setting a reasonable salary, John can take additional profits as distributions, reducing self-employment taxes.

John’s salary of $120,000 aligns with industry standards and optimizes his tax strategy by allowing for significant distributions without overpaying payroll taxes.

Frequently Asked Questions (FAQs)

Conclusion

Determining a reasonable salary is a vital component of your corporation’s tax strategy and compliance framework. By understanding the IRS guidelines, considering various influencing factors, and utilizing appropriate tools and resources, you can set a compensation level that is both fair and tax-efficient.

Regularly reviewing and adjusting your salary in line with your business’s growth, industry standards, and personal contributions ensures ongoing compliance and optimal tax benefits. Avoid common pitfalls by maintaining thorough documentation, staying informed about tax law changes, and seeking professional advice when needed.

Embrace these best practices to not only comply with regulatory requirements but also to foster a financially healthy and sustainable business environment. A well-considered reasonable salary serves as the foundation for effective financial planning and long-term business success.