💳 PayPal Fee Calculator for Sellers & Buyers

For Sellers (Receiving)

For Buyers (Sending)

Calculate PayPal Seller Fees

💡 Current Fee: 2.9% + $0.30 USD (subject to change)

PayPal Fee:

Amount You Receive:

Amount to Charge:

📊 Fee Breakdown:

Understanding PayPal Fees

PayPal charges fees for most commercial transactions to cover payment processing costs and fraud protection. The fee structure varies based on transaction type, whether it's domestic or international, and the payment method used. Understanding these fees is essential for sellers to price products correctly and for buyers to know the total cost of transactions.

Goods & Services (US)

2.9% + $0.30

Standard domestic rate

International

4.4% + fixed fee

Higher for cross-border

Friends & Family

Free (bank/balance)

$0 if funded correctly

Credit/Debit Card

2.9% + $0.30

Card-funded payments

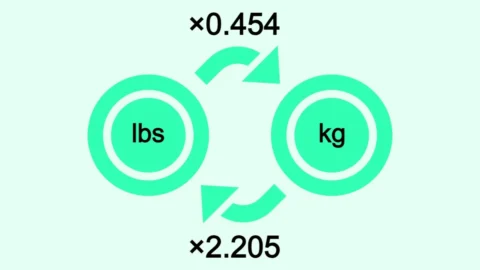

PayPal Fee Formula

Standard Fee Calculation

For Goods & Services (Domestic US):

PayPal Fee = (Transaction Amount × 2.9%) + $0.30

Amount Received = Transaction Amount - PayPal Fee

Reverse Calculation (How Much to Charge)

Amount to Charge = (Desired Amount + $0.30) ÷ (1 - 0.029)

Example Calculation:

If a seller wants to receive exactly $100:

Step 1: Add fixed fee → $100 + $0.30 = $100.30

Step 2: Divide by (1 - percentage) → $100.30 ÷ 0.971 = $103.30

Result: Charge customer $103.30 to receive $100 after fees

Verification: $103.30 × 2.9% = $3.00, plus $0.30 = $3.30 fee. $103.30 - $3.30 = $100.00 ✓

Tips for Sellers and Buyers

💰 For Sellers: Maximize Your Profits

- Calculate fees in advance: Use this calculator before pricing products

- Factor fees into pricing: Add PayPal fees to your product cost

- Use the reverse calculator: Determine how much to charge to receive your desired amount

- Encourage bank/balance funding: Lower fees for Friends & Family payments

- Consider alternatives for large transactions: Bank transfers may be cheaper

- Keep records: Track all fees for tax deductions

- Avoid chargebacks: Use tracking and require signatures

🛒 For Buyers: Understand Payment Costs

- Use Friends & Family wisely: Only for trusted transactions (no buyer protection)

- Fund from bank/balance: Avoid extra fees when possible

- Check international fees: Cross-border payments cost more

- Goods & Services = Protection: Worth the fee for seller accountability

- Understand who pays: Fees typically deducted from recipient

- Currency conversion: Additional 2.5-4% fee for currency exchange

Frequently Asked Questions

How do I calculate PayPal fees for sellers?

To calculate PayPal fees for sellers: multiply the transaction amount by 2.9% (0.029), then add $0.30. Formula: Fee = (Amount × 0.029) + $0.30. For $100, the fee is ($100 × 0.029) + $0.30 = $3.20. The seller receives $96.80 after fees.

What is the PayPal fee for $100?

For a $100 Goods & Services transaction in the US, the PayPal fee is $3.20 (calculated as $100 × 2.9% = $2.90, plus $0.30 fixed fee). The seller receives $96.80 after fees. For Friends & Family funded by bank account or PayPal balance, there's no fee.

How much should I charge to receive a specific amount after PayPal fees?

To receive a specific amount, use the reverse formula: Amount to Charge = (Desired Amount + $0.30) ÷ 0.971. To receive $100, charge ($100 + $0.30) ÷ 0.971 = $103.30. This covers the 2.9% + $0.30 fee, ensuring you receive exactly $100.

What are PayPal fees for buyers?

PayPal fees for buyers depend on payment method: Friends & Family funded by bank/balance = $0, credit/debit card = 2.9% + $0.30. Goods & Services fees are typically deducted from the seller, not buyer. International payments and currency conversions incur additional fees (2.5-4%).

Are PayPal fees different for international transactions?

Yes, international PayPal fees are higher. Standard international rate is 4.4% + fixed fee (varies by currency) for Goods & Services. Currency conversion adds another 2.5-4% fee. For example, receiving $100 from another country could cost $4.70 + currency conversion fees, totaling $7-8 in fees.

Is there a fee for PayPal Friends and Family?

PayPal Friends and Family is FREE when funded by bank account or PayPal balance (domestic). However, there's a 2.9% + $0.30 fee if funded by credit/debit card. International Friends & Family payments incur fees of approximately 5% + fixed fee. Note: Friends & Family offers no buyer/seller protection.

Can sellers ask buyers to cover PayPal fees?

In some cases, yes, but it's against PayPal's Merchant Agreement to add surcharges for credit card payments in certain jurisdictions. However, sellers can: (1) Build fees into product pricing, (2) Offer discounts for bank transfers, or (3) In some countries, add a "PayPal option" with different pricing. Check local laws and PayPal's terms.

What's the difference between Goods & Services and Friends & Family?

Goods & Services: 2.9% + $0.30 fee, buyer/seller protection, for commercial transactions. Friends & Family: Free (bank/balance funded), no protection, for personal gifts only. Using Friends & Family for business violates PayPal's terms and eliminates buyer protection if issues arise. Always use Goods & Services for purchases.

How do PayPal fees compare to other payment processors?

PayPal (2.9% + $0.30) is comparable to: Stripe (2.9% + $0.30), Square (2.6% + $0.10 online, 2.75% in-person), Venmo Business (1.9% + $0.10). Bank transfers/ACH are cheapest ($0-$0.25) but slower. PayPal's advantage is widespread user adoption and integrated buyer protection.

Are PayPal fees tax deductible for businesses?

Yes, PayPal fees are generally tax-deductible business expenses in most countries. Keep detailed records of all transaction fees. Report fees as "merchant processing fees" or "payment processing costs." Consult a tax professional for specific guidance based on your location and business structure.