Home Equity Loan Calculator

Property Information

Loan Details

Additional Options

Loan Summary

Available Equity

$150,000

Combined LTV Ratio

85.7%

Monthly Payment

$927.01

Total Interest

$66,861.80

Home Equity Breakdown

Loan Details

| First Payment | June 1, 2025 |

| Last Payment | May 1, 2040 |

| Number of Payments | 180 |

| Total of All Payments | $166,861.80 |

| Payment # | Date | Payment | Principal | Interest | Remaining Balance |

|---|

This calculator provides estimations only and should not be considered financial advice. Actual loan terms may vary. Consult a financial professional before making decisions.

🧾 What Is a Home Equity Loan?

A home equity loan, also known as a second mortgage, allows homeowners to borrow money by leveraging the equity they’ve built in their property.

In simple terms:

Your home’s equity = current market value – outstanding mortgage balance

Home equity loans provide a lump sum amount with fixed interest rates and fixed repayment terms, making them ideal for:

Home improvements

Debt consolidation

Education expenses

Medical emergencies

Major purchases

🔢 What Is a Home Equity Loan Calculator?

A Home Equity Loan Calculator is a free tool that helps homeowners estimate:

✅ How much they can borrow against their home’s equity

✅ The total loan amount they may qualify for

✅ Estimated monthly payments

✅ Interest costs over the life of the loan

It helps you make smarter financial decisions—without going through a full credit application.

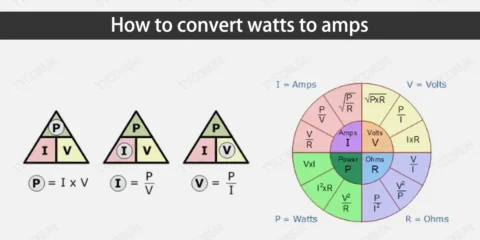

🧮 How Does the Calculator Work?

To determine how much you can borrow, lenders typically allow up to 80%–90% of your home’s appraised value, minus what you owe on your mortgage.

🧠 Formula:

Maximum Loan Amount = (Home Value × Allowed LTV %) – Current Mortgage Balance

📊 Inputs You’ll Need

Here’s what to enter into the calculator:

| Input | Description |

|---|---|

| Home’s Current Market Value | Your property’s appraised or estimated value |

| Outstanding Mortgage Balance | What you still owe on your home loan |

| Loan-to-Value Limit (LTV%) | Typically 80%, but some lenders offer up to 90% |

| Loan Term | Usually 5–30 years |

| Interest Rate | Fixed annual rate (e.g., 7%) |

👉 The output will show:

Estimated loan amount

Monthly payment amount

Total interest over the loan term

📌 Example Calculation

Let’s say:

Home Value = $400,000

Mortgage Balance = $200,000

Lender allows up to 85% LTV

Interest rate = 7%

Loan term = 15 years

Step 1: Max Loan Value

= 85% of $400,000 = $340,000

Step 2: Subtract Mortgage Balance

= $340,000 – $200,000 = $140,000 available equity

If you borrow $100,000 of that, your monthly payments might be around $898/month (depending on rate & term).

🔐 Key Benefits of Using a Home Equity Loan Calculator

✅ Helps you pre-qualify before approaching a lender

✅ Allows you to compare multiple scenarios

✅ Gives a clear view of monthly payments and total interest

✅ Supports debt management and financial planning

⚖️ Pros & Cons of Home Equity Loans

✅ Pros:

Fixed interest rates

Predictable monthly payments

Potentially lower rates than credit cards

Interest may be tax-deductible (if used for home improvements)

❌ Cons:

Uses your home as collateral

Less flexibility than HELOCs (Home Equity Lines of Credit)

Can lead to foreclosure if not repaid

Adds debt on top of your existing mortgage

🔁 Home Equity Loan vs. HELOC (Quick Comparison)

| Feature | Home Equity Loan | HELOC |

|---|---|---|

| Loan Type | Lump sum | Revolving credit line |

| Interest Rate | Fixed | Usually variable |

| Repayment | Fixed term (5–30 years) | Flexible draw/payback |

| Best For | Large one-time expenses | Ongoing/uncertain costs |

📱 Who Should Use the Home Equity Loan Calculator?

This tool is ideal for:

✔️ Homeowners looking to tap into equity

✔️ Financial advisors creating client scenarios

✔️ DIY renovators planning budgets

✔️ Anyone comparing loan options

✔️ People consolidating high-interest debt

🧠 Tips Before You Apply

✅ Check your credit score – higher scores = better rates

✅ Compare lenders – fees, interest rates, loan terms vary

✅ Know your home’s value – get a professional appraisal if possible

✅ Don’t overborrow – leave a cushion of equity for safety

✅ Understand all fees – closing costs, origination fees, and insurance

🏁 Final Thoughts

A Home Equity Loan Calculator puts the power back in your hands. Before meeting a lender or signing anything, know your numbers, weigh your options, and protect your financial future.

💬 Got questions about home equity loans or comparing them with HELOCs? Drop them below or connect with a licensed mortgage advisor.