Car insurance is a crucial aspect of responsible vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen incidents. However, one of the most common questions drivers have is, “How much is car insurance?” The answer isn’t one-size-fits-all, as premiums vary based on multiple factors. In this comprehensive guide, we’ll explore the key elements that influence car insurance costs, average premiums, tips to lower your rates, and much more. Whether you’re a new driver or looking to renew your policy, this article will equip you with the knowledge to make informed decisions about your car insurance.

Table of Contents

- Understanding Car Insurance Costs

- Factors That Affect Car Insurance Premiums

- Average Car Insurance Costs by State

- Types of Car Insurance Coverage

- How to Calculate Your Car Insurance Premium

- Tips to Lower Your Car Insurance Costs

- How to Choose the Right Car Insurance Policy

- Frequently Asked Questions (FAQs)

- Conclusion

Understanding Car Insurance Costs

Car insurance costs, often referred to as premiums, are the amounts you pay to an insurance company to protect against financial loss from accidents, theft, or other vehicle-related damages. These costs can vary widely based on individual circumstances and the specific coverage options you select.

Why Car Insurance Costs Matter

Understanding how much car insurance is and what influences its cost can help you:

- Budget Effectively: Allocate the right amount of funds for your insurance needs.

- Choose Appropriate Coverage: Ensure you have adequate protection without overpaying.

- Take Advantage of Discounts: Identify opportunities to reduce your premiums.

Factors That Affect Car Insurance Premiums

Several variables determine how much you’ll pay for car insurance. Here’s a detailed look at the primary factors:

Age and Gender

- Age: Younger drivers, especially those under 25, typically face higher premiums due to their inexperience and higher risk of accidents.

- Gender: Statistically, young males are more likely to be involved in accidents, leading to higher premiums compared to females of the same age group.

Driving History

- Accidents: A history of accidents can significantly increase your premiums.

- Traffic Violations: Tickets for speeding, running red lights, or other violations indicate higher risk.

- Claims History: Frequent claims suggest a propensity for filing future claims, raising costs.

Location

- Urban vs. Rural: Drivers in urban areas often pay more due to higher traffic density and increased risk of accidents and theft.

- State Regulations: Insurance requirements and costs vary by state based on local laws and economic factors.

- Crime Rates: Higher rates of vehicle theft and vandalism in your area can elevate premiums.

Type of Vehicle

- Make and Model: Luxury, sports, and high-performance cars usually cost more to insure due to higher repair costs and greater risk of theft.

- Age of Vehicle: Newer cars may cost more to insure because they are more expensive to replace or repair.

- Safety Features: Vehicles equipped with advanced safety features may qualify for discounts.

Coverage Levels

- Liability Limits: Higher liability coverage increases premiums but offers more protection.

- Deductibles: Lower deductibles result in higher premiums, while higher deductibles can reduce your costs.

- Additional Coverage: Comprehensive and collision coverage add to the overall premium but provide broader protection.

Credit Score

In many states, insurers use credit scores to assess risk. A higher credit score can lead to lower premiums, while a lower score may increase costs.

Mileage

- Annual Mileage: Drivers who spend more time on the road generally face higher premiums due to increased exposure to potential accidents.

- Purpose of Use: Commuting for work versus using the vehicle occasionally can affect your rates.

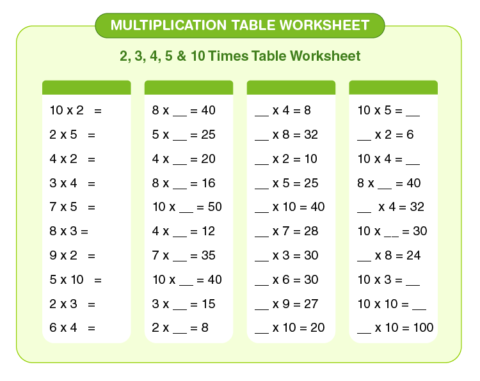

Average Car Insurance Costs by State

Car insurance costs vary significantly across different states due to varying regulations, population density, and other local factors. Here’s a snapshot of the average annual premiums in select states (as of 2024):

| State | Average Annual Premium |

|---|---|

| Michigan | $2,000 |

| Louisiana | $1,900 |

| Florida | $1,800 |

| Texas | $1,700 |

| California | $1,650 |

| New York | $1,600 |

| Ohio | $1,550 |

| Pennsylvania | $1,500 |

| Illinois | $1,450 |

| Georgia | $1,400 |

Note: These figures are approximate and can vary based on individual circumstances.

Types of Car Insurance Coverage

Understanding the different types of car insurance coverage is essential to determine how much coverage you need and how it affects your premium.

Liability Insurance

Liability insurance covers damages and injuries you cause to others in an accident. It typically includes:

- Bodily Injury Liability: Covers medical expenses, lost wages, and legal fees if you’re at fault in an accident.

- Property Damage Liability: Covers repairs or replacement of the other party’s property.

Note: Most states require a minimum level of liability insurance.

Collision Insurance

Collision insurance covers the cost of repairing or replacing your vehicle if it’s damaged in a collision with another vehicle or object, regardless of who is at fault.

Comprehensive Insurance

Comprehensive insurance covers non-collision-related damages to your vehicle, such as:

- Theft

- Vandalism

- Natural disasters (e.g., hail, floods, earthquakes)

- Falling objects

- Fire

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) covers medical expenses and, in some cases, lost wages and other related costs for you and your passengers, regardless of who is at fault.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance or no insurance at all. It can cover medical expenses and property damage.

How to Calculate Your Car Insurance Premium

Calculating your car insurance premium involves assessing various factors that influence your risk profile. Here’s a step-by-step approach:

Determine Your Coverage Needs:

- Decide on the types and levels of coverage you require based on your vehicle’s value, your financial situation, and state requirements.

Gather Personal Information:

- Age, gender, marital status, and address.

- Driving history, including any accidents or violations.

Select Your Vehicle:

- Provide details about your car, such as make, model, year, VIN, and safety features.

Choose Deductibles and Limits:

- Higher deductibles can lower your premium, while higher coverage limits offer more protection.

Apply for Quotes:

- Use online tools or contact insurance agents to receive multiple quotes based on the above information.

Compare and Adjust:

- Compare the quotes, adjusting coverage levels and deductibles to find a balance between cost and protection.

Tips to Lower Your Car Insurance Costs

High car insurance premiums can be a financial burden, but there are several strategies to reduce your costs without compromising coverage.

Shop Around and Compare Quotes

Obtaining quotes from multiple insurance providers allows you to compare rates and find the best deal. Online comparison tools make this process easier and more efficient.

Bundle Your Policies

Many insurers offer discounts if you bundle multiple policies, such as auto and home insurance, with the same provider.

Increase Your Deductible

Opting for a higher deductible means you’ll pay more out-of-pocket in the event of a claim, but it can lower your monthly premiums.

Maintain a Good Credit Score

A strong credit score demonstrates financial responsibility, which can lead to lower insurance rates. Regularly monitor and improve your credit score to take advantage of this benefit.

Take Advantage of Discounts

Insurance companies offer various discounts that can reduce your premiums, including:

- Safe Driver Discount: For maintaining a clean driving record.

- Good Student Discount: For students with good grades.

- Low Mileage Discount: If you drive fewer miles than average.

- Safety Features Discount: For vehicles equipped with anti-theft devices, airbags, and other safety features.

Drive Safely and Maintain a Clean Record

Avoiding accidents and traffic violations not only keeps you safe but also helps maintain lower insurance premiums over time.

How to Choose the Right Car Insurance Policy

Selecting the right car insurance policy involves more than just finding the lowest premium. Consider the following factors to ensure you get the best coverage for your needs:

Assess Your Coverage Needs

Evaluate the value of your vehicle, your driving habits, and your financial situation to determine the appropriate level of coverage.

Understand the Policy Terms

Read the policy details carefully to understand what is and isn’t covered, including any exclusions or limitations.

Consider the Insurer’s Reputation

Research the insurance company’s reputation for customer service, claims processing, and financial stability. Reviews and ratings from organizations like the Better Business Bureau (BBB) can provide valuable insights.

Evaluate Customer Support

Choose an insurer that offers reliable customer support through multiple channels, such as phone, email, and online chat, especially during emergencies.

Check for Flexibility

Ensure the policy allows for adjustments, such as adding or removing coverage options, as your needs change over time.

Frequently Asked Questions (FAQs)

1. What is the average cost of car insurance?

The average cost varies by state, age, driving history, and coverage levels. Nationwide averages range from $1,200 to $2,000 annually.

2. How can I lower my car insurance premium?

You can lower premiums by shopping around, bundling policies, increasing deductibles, maintaining a good credit score, and taking advantage of available discounts.

3. Does my credit score affect my car insurance rates?

Yes, in most states, a higher credit score can lead to lower premiums, as it indicates financial responsibility.

4. What factors increase my car insurance costs?

Factors include a young or older age, poor driving history, high-risk location, expensive vehicle, and low credit score.

5. Is comprehensive insurance necessary?

Comprehensive insurance is beneficial for protecting against non-collision-related damages, especially if you own a newer or valuable vehicle.

6. Can I change my car insurance provider at any time?

Yes, you can switch providers at any time, but ensure there’s no lapse in coverage and review any cancellation policies or fees.

7. What is a deductible, and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before insurance coverage kicks in. Higher deductibles typically result in lower premiums.

8. Do I need car insurance if I have an older vehicle?

Yes, most states require at least liability insurance, regardless of the vehicle’s age.

9. How does my driving record impact my insurance rates?

A clean driving record usually leads to lower premiums, while accidents and violations can increase costs.

10. What should I do if I can’t afford my car insurance?

Contact your insurer to discuss payment plans, adjust coverage levels, or explore discounts. You may also consider shopping around for more affordable options.

Conclusion

Determining how much car insurance is involves understanding a myriad of factors that influence your premiums. By assessing your personal circumstances, maintaining a good driving record, and leveraging available discounts, you can find a policy that offers the right balance of coverage and affordability. Remember to regularly review your insurance needs and shop around to ensure you’re getting the best deal possible.

For more information or to get personalized car insurance quotes, visit reputable providers like Progressive Insurance, Geico, State Farm, or Allstate. Empower yourself with the knowledge to make informed decisions and protect yourself on the road.