Return on Investment (ROI) Calculator

Calculate your overall ROI and annualized ROI (approx.) based on initial costs, final amount, and the time period.

ROI Calculator

Time Period (for Annualized ROI)

ROI Formula & Info

Basic ROI Formula:

ROI (%) = [(Final Value – Total Cost) / Total Cost] × 100

Annualized ROI (Approx.):

Annualized ROI (%) = {[(Final Value / Total Cost)^(1 / Years)] – 1} × 100

Note: This calculator uses a simple approximation for annualization, dividing the day difference by 365. Real-world calculations may vary, especially for compounding, monthly contributions, or partial periods.

Imagine this: What if you could predict the financial success of your business decision with just a few clicks? According to recent studies, companies that leverage advanced analytics in their decision-making process are up to 30% more likely to see improved returns. Whether you’re a small business owner, a digital marketer, or an investor, understanding and calculating ROI (Return on Investment) is essential. This comprehensive guide on the ROI Calculator will show you how this powerful tool can help you measure the effectiveness of your investments, optimize spending, and ultimately boost your bottom line.

In this post, we’ll cover:

- What an ROI Calculator Is: A clear definition along with its historical evolution and background.

- How ROI Calculators Work: An in-depth look at the key components, formulas, and technology behind them.

- Types of ROI Calculators: From basic online tools to advanced software integrated into financial systems.

- Real-World Applications: Practical examples, case studies, and scenarios illustrating how businesses and individuals use ROI calculators.

- Actionable Tips and Best Practices: Strategies to maximize your ROI calculations and avoid common pitfalls.

- Frequently Asked Questions (FAQ): Addressing common misconceptions and questions about ROI calculators.

- Conclusion and Call-to-Action: A succinct summary of key points and ways to further engage with this essential financial tool.

By the end of this guide, you’ll have a solid understanding of how an ROI Calculator can empower you to make smarter financial decisions, whether you’re analyzing a marketing campaign, evaluating a new project, or managing your overall investment portfolio.

Table of Contents

- Introduction: The Power of ROI Calculators

- What Is an ROI Calculator?

- How Does an ROI Calculator Work?

- Types of ROI Calculators

- Real-World Applications of ROI Calculators

- Actionable Tips and Best Practices

- Frequently Asked Questions (FAQ)

- Conclusion and Call-to-Action

- Additional Resources

Introduction: The Power of ROI Calculators

Have you ever launched a marketing campaign or invested in a new project only to wonder, “Was that really worth it?” In today’s competitive landscape, every dollar counts, and understanding the return on your investment is crucial. The ROI Calculator is a transformative tool that helps you break down the numbers behind your investments, providing clarity and guiding you toward smarter decision-making.

Consider this: In 2022, nearly 65% of businesses reported that using ROI calculators significantly improved their financial planning and budgeting accuracy. Whether you’re managing a multi-million-dollar enterprise or a small startup, the ROI Calculator can be your secret weapon for financial success.

In the following sections, we’ll explore:

- The definition and history of the ROI Calculator.

- The inner workings and essential components of ROI calculation.

- Various types of ROI calculators available today.

- Real-world examples demonstrating how ROI calculators are applied across different sectors.

- Tips and best practices to get the most out of your ROI calculator.

- A dedicated FAQ section to answer all your burning questions about ROI calculators.

Let’s dive into the world of ROI calculators and discover how you can use them to make informed, data-driven decisions.

What Is an ROI Calculator?

Definition and Overview

A ROI Calculator is a digital tool designed to compute the Return on Investment (ROI) for a given project, campaign, or financial decision. ROI is a key performance indicator (KPI) that measures the efficiency or profitability of an investment relative to its cost. Essentially, it answers the question: “How much profit did I make for every dollar spent?”

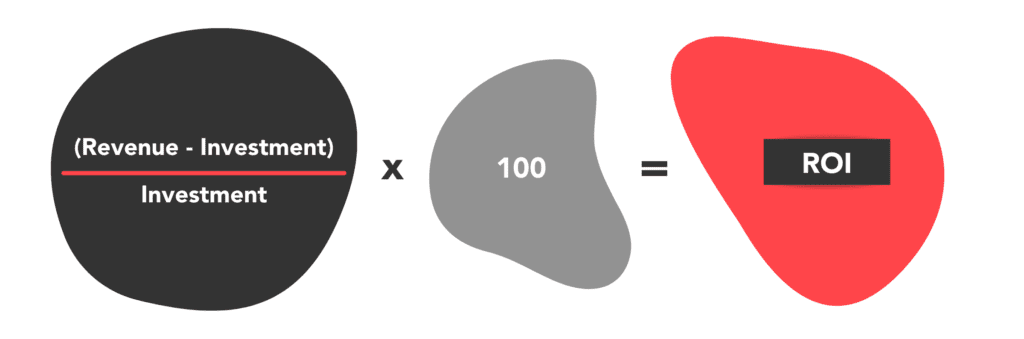

The formula for ROI is typically expressed as:

ROI=Net ProfitCost of Investment×100\text{ROI} = \frac{\text{Net Profit}}{\text{Cost of Investment}} \times 100ROI=Cost of InvestmentNet Profit×100

Where:

- Net Profit is the gain from the investment minus the cost.

- Cost of Investment is the total amount spent on the investment.

Key Attributes of an ROI Calculator:

- Accuracy: Uses precise financial formulas to provide an exact return percentage.

- User-Friendly Interface: Simplifies complex financial data into understandable metrics.

- Versatility: Can be used across various industries—from digital marketing to manufacturing.

- Speed: Offers instant calculations, making it easier to compare different investment scenarios.

- Customization: Many ROI calculators allow users to adjust variables to reflect different costs, time frames, and financial conditions.

An ROI Calculator is essential for anyone looking to measure the success of an investment, understand the financial impact of business decisions, or optimize spending to achieve better profitability.

Historical Background

The concept of ROI has been around for decades, serving as a cornerstone of financial analysis and investment strategy. Here’s a brief history:

Early Financial Analysis:

Before the advent of digital tools, investors and financial analysts relied on manual calculations, spreadsheets, and financial statements to determine the profitability of an investment. This process was often time-consuming and prone to human error.The Rise of Digital Tools:

With the development of computers and financial software in the late 20th century, tools like ROI calculators emerged to automate and simplify the calculation process. Early ROI calculators were basic programs built into spreadsheets like Microsoft Excel.Modern ROI Calculators:

Today, ROI calculators have evolved significantly. They are available as standalone web applications, integrated modules within broader financial software suites, and even mobile apps. These modern tools not only calculate ROI but also offer additional features such as scenario analysis, forecasting, and data visualization.

Understanding the evolution of the ROI Calculator highlights its importance as a tool that has grown with technological advancements, becoming indispensable for modern financial management.

How Does an ROI Calculator Work?

Key Components and Formulas

At the heart of every ROI Calculator lies a simple yet powerful formula. The basic ROI formula is:

ROI=Net ProfitCost of Investment×100\text{ROI} = \frac{\text{Net Profit}}{\text{Cost of Investment}} \times 100ROI=Cost of InvestmentNet Profit×100

However, real-world scenarios often require more complex calculations, incorporating various factors such as:

- Time Value of Money: Considering the effects of inflation or discount rates.

- Multiple Revenue Streams: Aggregating different sources of income from a single investment.

- Indirect Costs: Accounting for overhead, maintenance, or opportunity costs.

- Risk Factors: Including probabilistic scenarios where outcomes are uncertain.

Components of an ROI Calculator:

Input Fields:

- Revenue/Profit: The total gains generated by the investment.

- Investment Costs: All expenses incurred, including initial outlay and ongoing costs.

- Time Period: The duration over which the ROI is calculated (e.g., monthly, quarterly, annually).

- Additional Variables: Options to input additional factors like depreciation, taxes, and discount rates.

Calculation Engine:

This is the “brain” of the ROI calculator. It processes the input data through the ROI formula (or a modified version of it) to produce a result.Output Display:

The final ROI is usually displayed as a percentage, providing a clear indicator of the investment’s profitability.Graphical Representations (in advanced models):

Some ROI calculators include charts or graphs to help users visualize trends over time, compare different scenarios, or understand the impact of variable changes.

Understanding the User Interface

Modern ROI calculators are designed with user experience in mind. Here’s how to navigate the interface effectively:

Simple Input Fields:

Look for clear fields where you can enter financial data such as costs, revenue, and time frames. Many calculators use drop-down menus or sliders for ease of use.Customizable Settings:

Advanced calculators allow you to toggle between different calculation methods (e.g., simple ROI vs. annualized ROI) and adjust assumptions like growth rates or discount factors.Real-Time Results:

As you input data, the calculator typically updates the ROI instantly, providing immediate feedback on how changes in variables affect your return.Error Handling:

Reliable ROI calculators come with built-in error-checking mechanisms to alert you if data is entered incorrectly or if calculations produce unrealistic results.

For more detailed guidance on navigating financial tools, consider visiting Investopedia’s Financial Calculator Section for additional insights and tutorials.

Types of ROI Calculators

ROI calculators come in various forms, each tailored to different needs and industries. Below, we explore the main categories:

Basic ROI Calculators

Basic ROI Calculators are designed for quick, straightforward computations. They typically include:

- Core Functionality:

Allowing users to input revenue, cost, and time period to compute a simple ROI percentage. - User-Friendly Design:

Simple interfaces with minimal clutter, ideal for small businesses, startups, or individuals. - Accessibility:

Often available as free online tools or simple apps.

Example Use Case:

A freelance digital marketer can use a basic ROI calculator to determine whether their advertising spend on a social media campaign resulted in a profitable return.

Advanced ROI Calculators and Financial Software

For those needing more detailed analysis, Advanced ROI Calculators offer enhanced features:

- Comprehensive Data Input:

These calculators allow you to incorporate multiple revenue streams, detailed cost breakdowns, and variable time frames. - Scenario Analysis:

Users can simulate different scenarios (e.g., changes in market conditions, budget adjustments) to forecast potential outcomes. - Integration with Financial Software:

Advanced tools are often embedded within larger financial management systems, allowing seamless data integration from accounting software or CRM systems. - Graphical Analysis:

Enhanced visualization tools, including charts, graphs, and dashboards, help users better understand trends and relationships.

Example Use Case:

A mid-sized enterprise evaluating a new product launch might use an advanced ROI calculator to model various market penetration scenarios, taking into account marketing spend, production costs, and potential revenue over several years.

Industry-Specific ROI Calculators

Different industries often require specialized ROI calculations. Some calculators are tailored to:

- Digital Marketing:

Focused on metrics like cost per click, conversion rates, and customer acquisition cost. - Real Estate:

Including variables such as property appreciation, rental income, and maintenance costs. - Manufacturing and Operations:

Incorporating production costs, efficiency improvements, and waste reduction.

Example Use Case:

A real estate investor could use an industry-specific ROI calculator to assess the potential return on a rental property investment by inputting factors like property value, rental income, and maintenance expenses.

For more examples and reviews of ROI calculators tailored to specific industries, check out Forbes’ List of Financial Tools.

Real-World Applications of ROI Calculators

The versatility of the ROI Calculator means it can be applied in numerous real-world scenarios. Here are some detailed examples:

Marketing and Advertising

In the world of marketing, ROI is a crucial metric that helps businesses determine the success of their campaigns. An ROI calculator can:

- Measure Campaign Success:

By comparing the revenue generated from a campaign against the marketing spend, businesses can determine whether the campaign was profitable. - Optimize Budget Allocation:

Marketers can use ROI calculations to decide which channels (social media, PPC, email marketing) yield the best returns, allowing them to allocate budgets more effectively. - Forecast Future Campaigns:

Using historical ROI data, businesses can predict the potential success of future campaigns and adjust strategies accordingly.

Case Study:

A digital marketing agency in New York launched a multi-channel campaign for a retail client. By using an ROI calculator, they determined that while social media ads had a higher initial cost, they generated a 25% higher ROI compared to traditional media channels. This insight enabled the client to shift more of their budget to digital channels, ultimately increasing overall profitability.

Business Investments and Project Analysis

ROI calculators are invaluable in evaluating the feasibility and success of business projects and investments:

- Project Feasibility:

Before committing resources, companies can use an ROI calculator to estimate whether the projected gains justify the initial outlay. - Resource Allocation:

By comparing the ROI of multiple projects, decision-makers can prioritize initiatives that promise the highest returns. - Long-Term Planning:

ROI calculators help businesses forecast long-term benefits, considering factors like recurring revenue, cost savings, and growth opportunities.

Case Study:

A manufacturing firm in the Midwest used an advanced ROI calculator to evaluate the potential of upgrading their production line with new technology. By factoring in reduced labor costs, lower error rates, and increased production speed, the ROI calculator projected a 40% return over five years. This data-driven analysis convinced the board to invest in the upgrade, which later resulted in significant operational efficiencies and cost savings.

Personal Finance and Investment Decisions

Even for individual investors, understanding ROI is key to making smart financial decisions:

- Investment Comparison:

Personal finance enthusiasts can use ROI calculators to compare different investment options, such as stocks, real estate, or small business ventures. - Budgeting and Savings:

By calculating the ROI on personal projects (like home improvements), individuals can decide whether an expense is justified by the anticipated increase in property value. - Tracking Financial Goals:

An ROI calculator can help track progress towards long-term financial goals, enabling individuals to adjust their saving or investment strategies as needed.

Real-World Example:

An individual investor in California used a free online ROI calculator to assess the return on investing in solar panels for their home. After factoring in installation costs, energy savings, and potential tax incentives, the ROI calculator revealed that the investment would break even in just over six years, leading the investor to proceed with the project.

Actionable Tips and Best Practices

To get the most out of your ROI Calculator, consider these actionable tips and strategies:

Maximizing Your ROI Calculator’s Potential

Input Accurate Data:

Double-check all the numbers you enter—accurate data is the foundation of a reliable ROI calculation.Break Down Costs:

Ensure that you account for all direct and indirect costs associated with the investment. Include hidden expenses such as maintenance, training, and overhead.Customize Your Variables:

Use ROI calculators that allow for customization. Adjust variables like time period, discount rates, and growth projections to reflect your specific situation.Run Multiple Scenarios:

Experiment with different inputs to see how changes in revenue, cost, or time affect your ROI. Scenario analysis can help you plan for best-case, worst-case, and most likely outcomes.Integrate with Other Tools:

If possible, use ROI calculators that integrate with your existing financial software or spreadsheets. This can streamline data entry and enhance accuracy.Regularly Update Your Data:

As market conditions change, so should your calculations. Regularly update your ROI figures to ensure your decisions are based on the most current information.

Common Pitfalls to Avoid

While ROI calculators are powerful, here are some common mistakes to watch out for:

Overlooking Indirect Costs:

Failing to include all costs can lead to an inflated ROI figure. Always consider both direct and indirect expenses.Relying on Outdated Data:

Using stale or inaccurate numbers can misguide your analysis. Ensure that your inputs reflect the most current and relevant data.Ignoring the Time Factor:

ROI is often time-sensitive. Consider whether you are calculating a short-term or long-term ROI, and adjust your variables accordingly.Assuming All Investments Are Equal:

Not all investments yield returns in the same manner. Customize your ROI calculator inputs to reflect the unique characteristics of each investment.Failing to Consider Risk:

While an ROI calculator provides a snapshot of potential returns, it may not capture all the risks involved. Consider supplementing your analysis with risk assessments or sensitivity analyses.

Frequently Asked Questions (FAQ)

Q1: What exactly is an ROI Calculator?

An ROI Calculator is a digital tool that calculates the Return on Investment by comparing the net profit from an investment to the cost of that investment, usually expressed as a percentage. It helps businesses and individuals evaluate the profitability of various financial decisions.

Q2: How do I calculate ROI manually?

The basic formula for ROI is:

ROI=Net ProfitCost of Investment×100\text{ROI} = \frac{\text{Net Profit}}{\text{Cost of Investment}} \times 100ROI=Cost of InvestmentNet Profit×100

Where Net Profit is the total revenue minus the total costs.

Q3: Can an ROI Calculator be used for different industries?

Absolutely. ROI calculators are versatile tools that can be customized for various industries, including digital marketing, real estate, manufacturing, and even personal finance.

Q4: Are there free ROI Calculators available online?

Yes, many free ROI Calculators are available on the internet. These can be simple web-based tools or mobile apps that allow you to input your data and receive an instant ROI calculation. For example, you might explore tools on sites like Investopedia or Forbes Advisor.

Q5: What should I do if my calculated ROI seems too high or too low?

First, double-check your inputs to ensure all costs and revenues are accurately accounted for. If the data is correct, consider whether external factors (such as market conditions or hidden costs) might be affecting your ROI. It might also be helpful to run multiple scenarios to see how sensitive your ROI is to different variables.

Q6: How often should I update my ROI calculations?

It depends on your investment. For dynamic markets or ongoing projects, updating your ROI calculations quarterly or annually can help you stay informed. For static investments, less frequent updates might be sufficient.

Q7: Can an ROI Calculator predict future returns?

While an ROI Calculator is excellent for analyzing historical data and current projections, it’s important to note that it is not a predictive tool in itself. It can simulate scenarios based on assumed variables, but external factors and market volatility may affect actual returns.

Conclusion and Call-to-Action

In a world where every dollar counts, a ROI Calculator is an invaluable asset that transforms complex financial data into actionable insights. By measuring the profitability of your investments, this tool empowers you to make informed decisions, optimize your budget, and drive your business forward.

Key Takeaways:

- What It Is: A digital tool that computes the return on investment by comparing net profit to investment costs.

- Historical Context: From manual calculations to advanced digital tools, ROI calculators have evolved to meet modern financial demands.

- How It Works: By inputting accurate data into a simple formula, ROI calculators deliver quick, precise profitability metrics.

- Types and Applications: Whether you need a basic online tool or an advanced, integrated system, there’s an ROI calculator tailored for your industry and needs.

- Best Practices: Use accurate data, run multiple scenarios, and update your calculations regularly for the best results.

- Real-World Impact: From marketing campaigns to personal investments, ROI calculators are crucial in guiding financial decisions and maximizing returns.

Now is the time to harness the power of the ROI Calculator to unlock smarter, data-driven decision-making. Whether you’re evaluating a new project, refining your marketing strategy, or assessing personal investments, this tool can provide the clarity you need to succeed.

Call-to-Action:

- Try It Out: Explore a free online ROI calculator today and input your next investment scenario. See firsthand how a few numbers can change your perspective on profitability.

- Share Your Insights: Have you used an ROI calculator to drive business success or personal financial decisions? Share your experiences in the comments below.

- Stay Connected: Subscribe to our newsletter for more expert advice, detailed guides on financial tools, and tips to maximize your investments.

Additional Resources

For more detailed guides and tools to enhance your financial analysis, check out these resources:

- Internal Links:

- Mastering Financial Metrics: A Guide to Key KPIs – Learn how essential metrics like ROI, ROE, and more can drive business success.

- Effective Budgeting Strategies for Small Businesses – Discover actionable tips to optimize your spending and maximize returns.

- External Links:

- Investopedia – ROI Explained – A comprehensive explanation of ROI and its importance.

- Forbes Advisor – Best ROI Calculators – Reviews and comparisons of various ROI calculation tools.

- Harvard Business Review – Data-Driven Decision Making – Articles and case studies on leveraging financial data to drive business strategies.

Final Thoughts

Understanding the true value of an investment is critical for success in both business and personal finance. The ROI Calculator is more than just a tool—it’s a gateway to strategic decision-making that can propel your projects, campaigns, and financial goals to new heights. By simplifying complex calculations and offering clear insights, ROI calculators enable you to focus on what really matters: making every dollar count.

Embrace the power of the ROI Calculator, and transform the way you evaluate your investments. With accurate data, detailed analysis, and proactive planning, you can optimize your resources and secure a brighter financial future.

Thank you for taking the time to read this comprehensive guide on ROI calculators. We hope you found it insightful and that it inspires you to leverage this powerful tool in your financial planning. Happy calculating, and here’s to making every investment count!